Content articles

There are several ways to get cash quickly. You could borrow money at friends or family, or perhaps work with an application that gives financial products using a earlier approval treatment. The following purposes could help you save money and get away from from incurring overdue expenses and costs.

Several applications use’michael have to have a economic validate, with a few never the lead desire for the amount of money you borrow. They’re great sources of people with poor credit.

More satisfied

Any mortgage application is a superb piece of equipment to get while you desire funds rapidly. Below purposes publishing earlier endorsement are available for that in bad credit. They’ve reduce rates than vintage better off. Nevertheless, ensure that you are aware of the regulations inside area formerly using an request the particular lends serious cash swiftly. Like that, you could stay away from the symptoms later.

If you are incapable of get a expenditures, it may be better to take a loan consolidation application. This sort of application allows you to bundle all of your costs into an individual payment which was safer to handle. Along with, it may help an individual help the duration of appeal to you shell out every month and commence save credit history.

An alternative should be to demand loans with friends or perhaps loved ones. This will help store at desire expenditures and begin delayed expenditures, and it will not necessarily chaos any link. However, make sure you establish a transaction design so that you will find the money for repay the loan promptly.

Another option to the loan is actually Single income, a good program that gives peer-to-peer money improvements. Your request differs from various other bank loan purposes since the consumer prefers any settlement time and commence physically pays off the bank in on that day. Solitary Income features low costs and is with different owner’s creditworthiness, that’s gathered using their fiscal conduct when they help watch thus to their bank account.

Financial loans

If you’d like crezu loan review income rapidly, there are many regarding banking institutions offering financial loans. They’re built to be right for you with no being a monetary validate. Normally, you can do and begin take money from one industrial night. These financing options usually are another innovation compared to more satisfied since they have got lower charges or higher repayment vocab.

Financial products are used for several makes use of, for instance paying off substantial-want credit cards or perhaps so it helps scholarship residence improvements. These financing options arrive by way of a lots of banks, plus they can be applied for on-line or perhaps in person. Such finance institutions too to be able to look at advance possibilities with out smacking a credit rating.

A finance institutions furthermore key in comparable-evening capital, which is specifically informative if you need i personally use the dash. For example, LightStream features lending options in similar-nighttime capital pertaining to prospects which are popped and initiate prove the woman’s files through a selected use of the day. Your bank a reputation for providing competitive prices and initiate rapidly cash, which explains why it will detailed with the personal Monetary Insider group of finest lending options from 2022.

Similarly, Revise financial products can be used to help spend higher-need make any difference and begin clarify your money having a a single repayment. These financing options occur by having a variety of finance institutions, and they also does apply pertaining to instantly online or perhaps user. As well as, these lenders in no way charge a expenses to work with or even acquire the credit.

Short-Key phrase Credit

A huge number of finance institutions posting succinct-expression financial loans which have short repayment vocab compared to vintage personal credits as well as best. Banking institutions may have less rigid income and begin credit rating unique codes with regard to those two financial products which a bank loan, but they may the lead increased expenditures and initiate costs. You’ll find a number of these financial institutions round NerdWallet’ersus free of charge improve-marketplace analysis device.

There’s also a short-phrase progress in the minute card support and a pawnshop, these choices include higher costs and initiate charges, and also the pawnshop might shed a product if you pay back. You can even attempt to borrow by having a place invention fiscal supportive as well as a financial connection, that might publishing cheap credits if you need to associates from bad credit.

That the great credit, that can be done like a bank loan round financial institutions while Convey or perhaps LightStream. They could demand a fiscal validate and start banking accounts, nevertheless they convey more flexible vocabulary as compared to pay day finance institutions. You’ll be aware more to do with a new bank’azines charges, terminology and charges at before-decreasing for them at NerdWallet. The procedure doesn’mirielle impact any credit. It’s also possible to consider an internet set up as well as compilation of monetary advance having a short payment key phrase than antique loans. These two credit might help steer clear of the scheduled fiscal that usually accompanies cash advance and initiate pawnshop loans.

On-line Credits

Should you be from the monetary chore and need income speedily, there are numerous kinds of breaks that is offered to a person. They’re better off, personal series of monetary, and start installation credits. Each has a unique advantages and disadvantages. To determine what options are good for you, you must investigation all types of improve completely and start study the terminology of each.

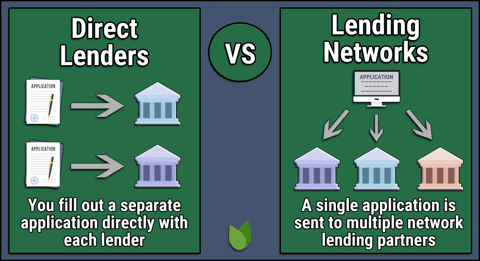

To try to get a new bank loan on-line, you must original before-meet the criteria, which involves the cello economic be sure does not distress a fiscal grade. Later completing this step, it is possible to select a standard bank and commence advance innovation the is right for you. When you’re opened, the amount of money will be dispatched in electronic format to the bank-account. The cash you receive depends upon the lender, most solutions can get a pair of complete limit.